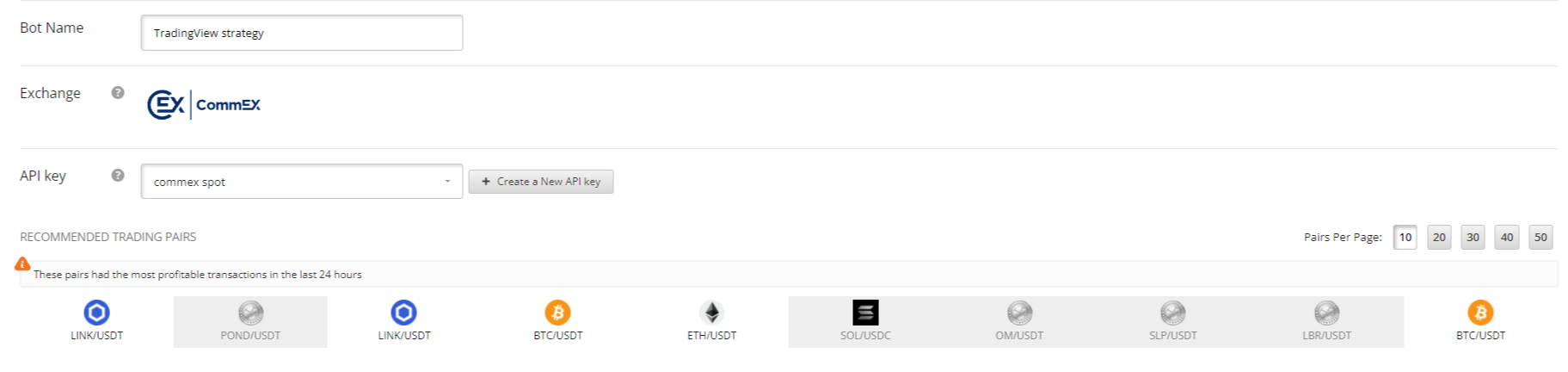

Creating a bot on the CommEX Spot exchange using the TradingView strategy

In this article we will show an example of setting up and connecting a bot to the TradingView strategy for the ltc/usdt trading pair, with the LONG algorithm on the CommEX Spot exchange, a deposit of 500USDT.

To create a new bot, you need to click on the “Create a new bot” button in the bots section.

- Set the name of the bot and select an API key, read how to create it here.

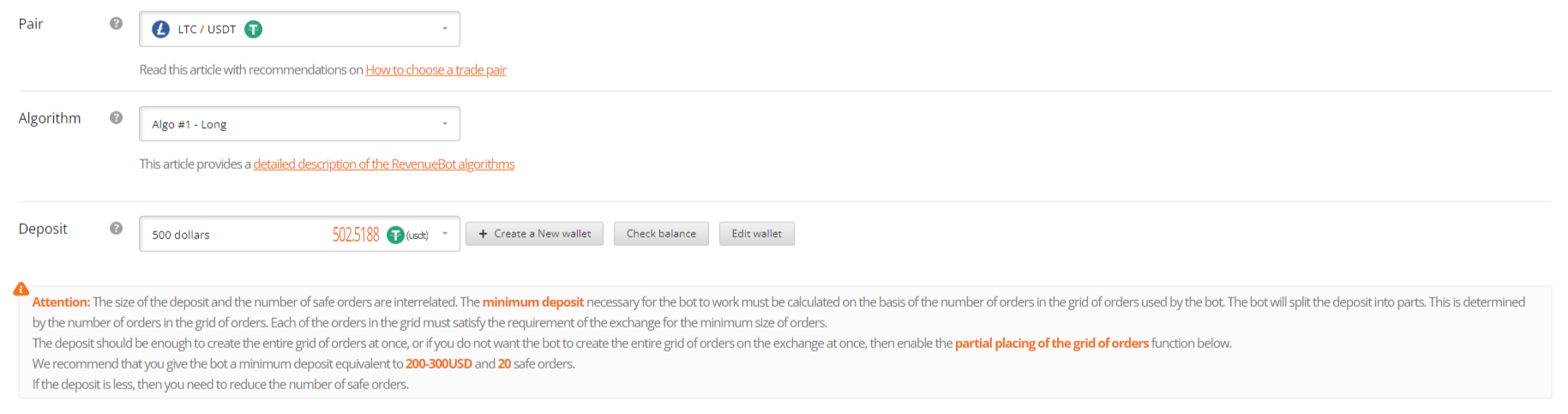

- We select the LTC/USDT pair to trade, set the LONG algorithm and determine the deposit for the bot.

In order to ask the bot for a deposit, you need to create a virtual wallet and assign an amount to it (in our case, 500USDT). Be sure to look at the information about the minimum deposit for the bot to work and what a wallet is and why it is needed

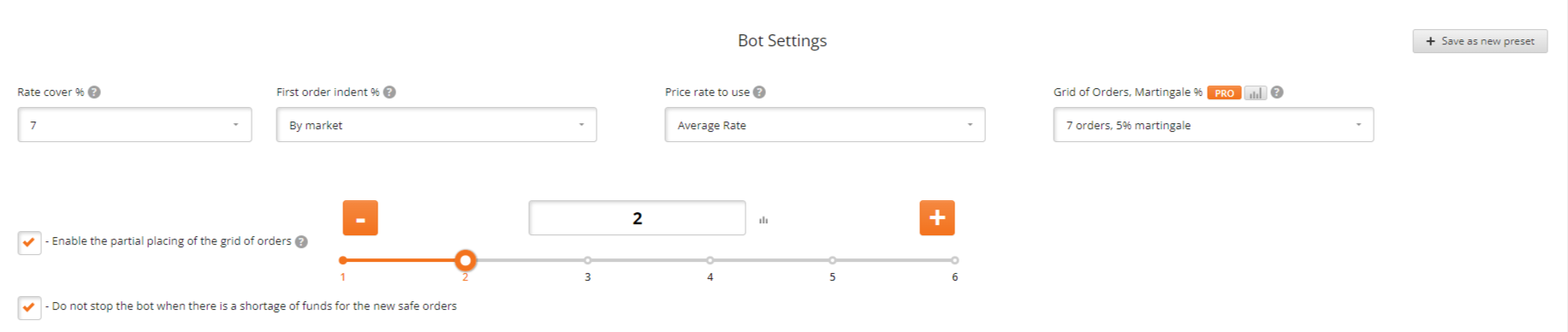

- Set the basic settings.

You can set the price change cover to the percentage of fluctuation in the price of the coin. Below in the instructions you will find an example of selecting the percentage of price change overlap based on this TradingView strategy.

We set the indent of the first order “by market” so that when a signal is received the bot immediately buys a coin.

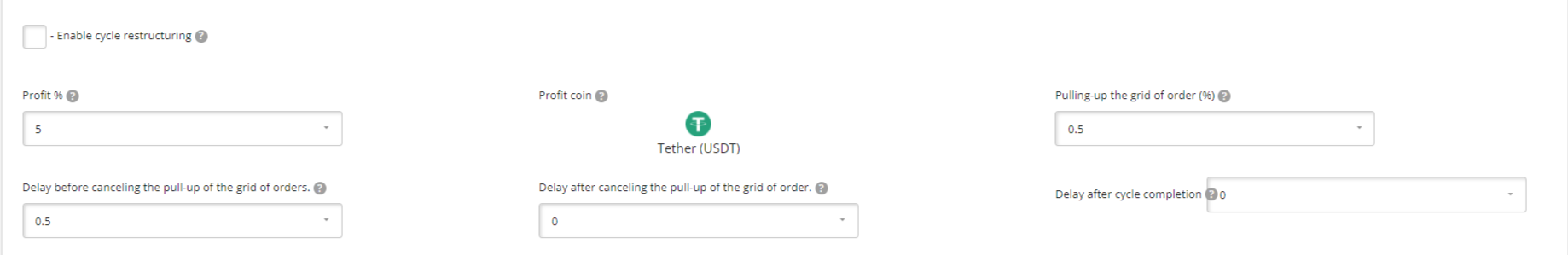

The profit percentage can be set to high, because... the strategy itself will rearrange the take profit order when receiving a signal from the opposite algorithm.

All settings are described in detail in our knowledge base. You can find detailed information on the basic settings here:

What is price change overlap and which one to choose?

What grid of orders and Martingale percentage to choose?

What is a partial placing of the grid of orders?

What is cycle restructuring?

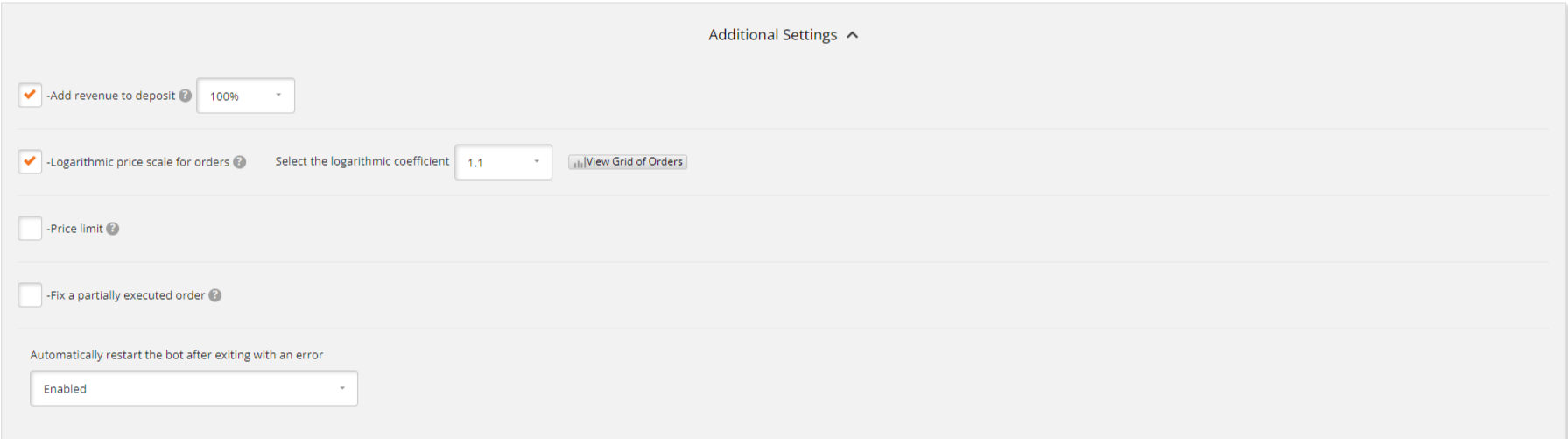

- In advanced settings we configure logarithmic price distribution.

- Be sure to enable the use of bot filters and install a stop-loss filter.

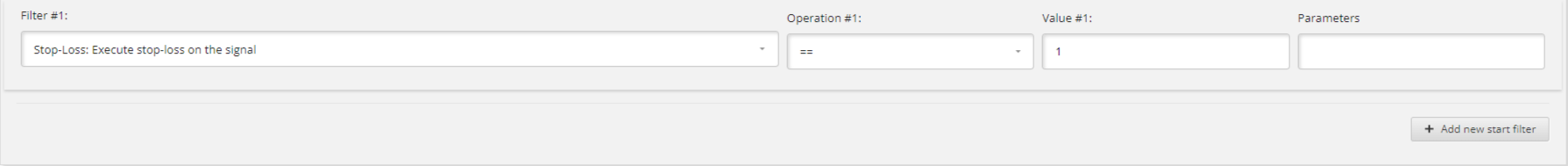

- We save the bot so that it receives its ID, then click on the “Edit bot” button and in the middle of the settings click on “Enable the bot to work with TradingView signals” and copy the URL for the signal.

-

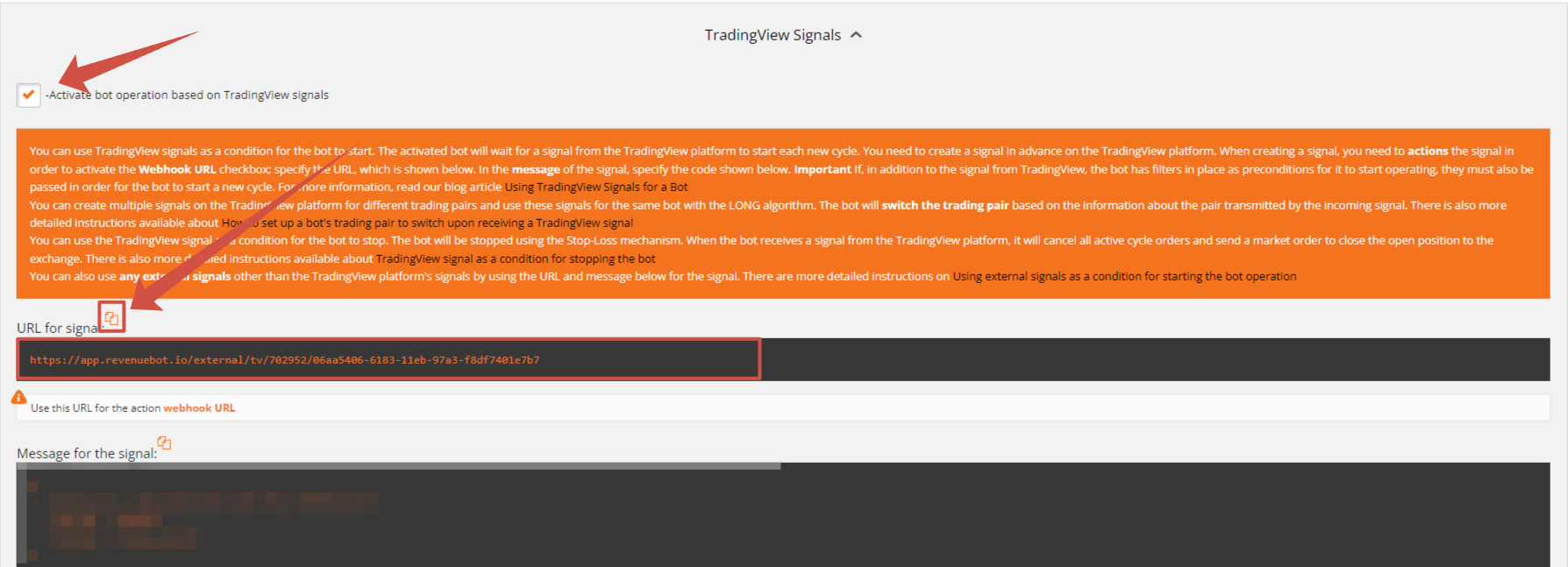

Next, go to your account on TradingView and open the chart of the currency you want to trade, in our example ltc/usdt.

Please note that to connect strategies you will need a paid subscription to the TradingView platform.

-

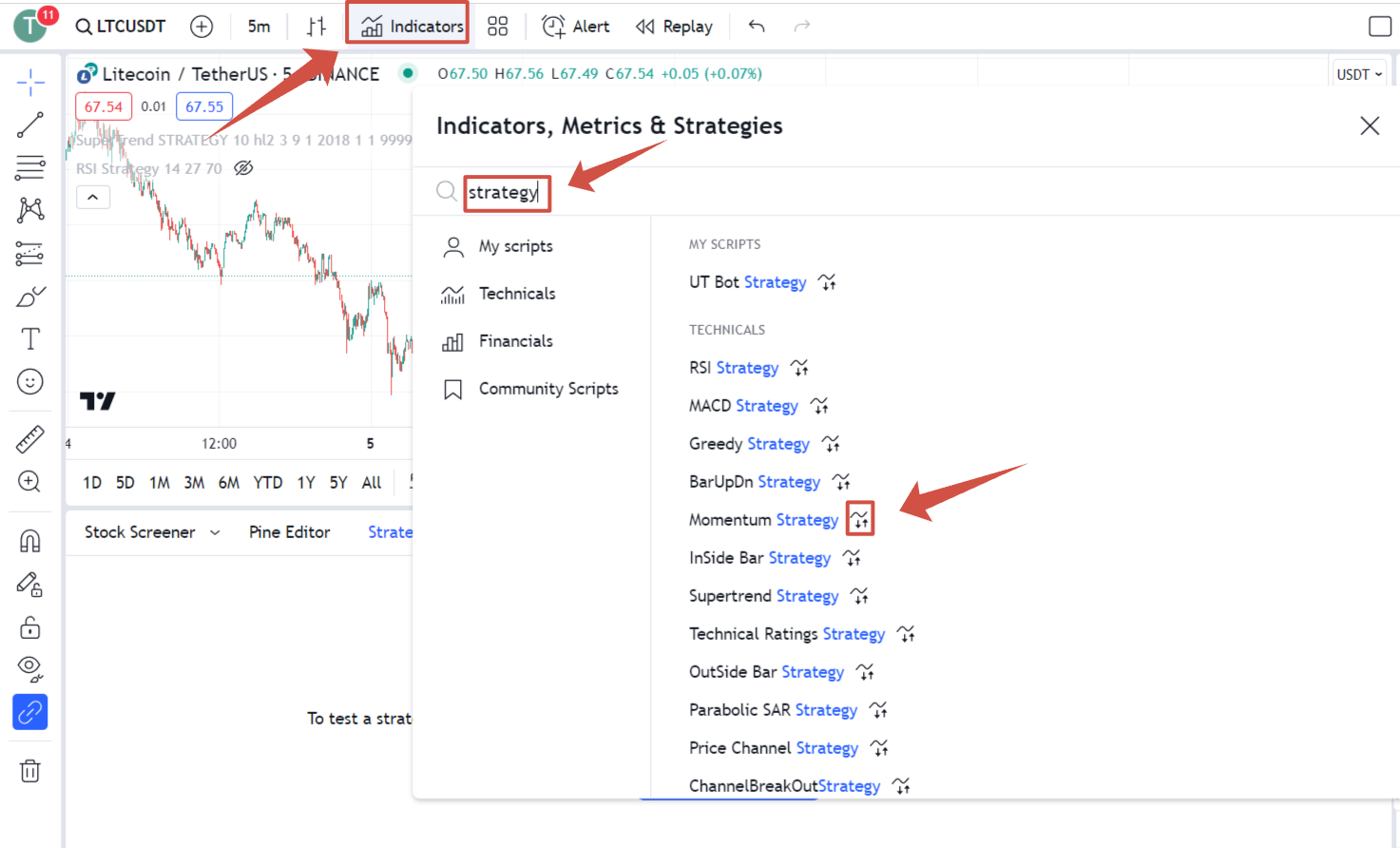

You can add any strategy available in the huge catalog on TradingView to the chart. To do this, click on the “Indicators” button, write “Strategy” in the search and select the strategy that suits you.

For testing, we chose the standard RSI strategy.

-

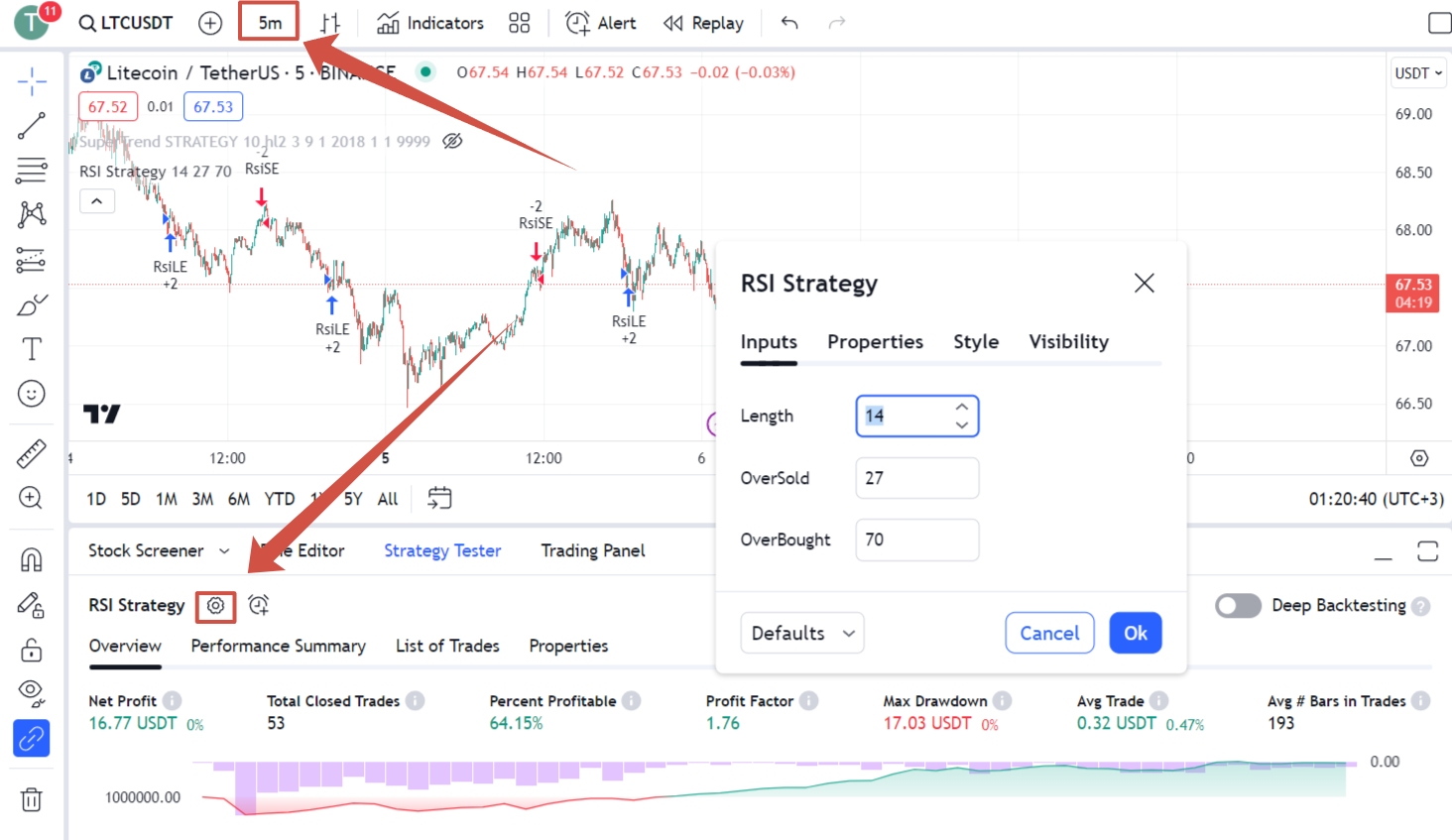

Now on the chart page you have a “Strategy Tester”, where you can change the settings and view the test results for a certain period of time. For each currency, for each time frame, you can select your own strategy parameters.

- You can also check the trading history for the previous maximum percentage of price deviation from the moment the trade was opened and set the percentage of price change overlap you need in the bot settings.

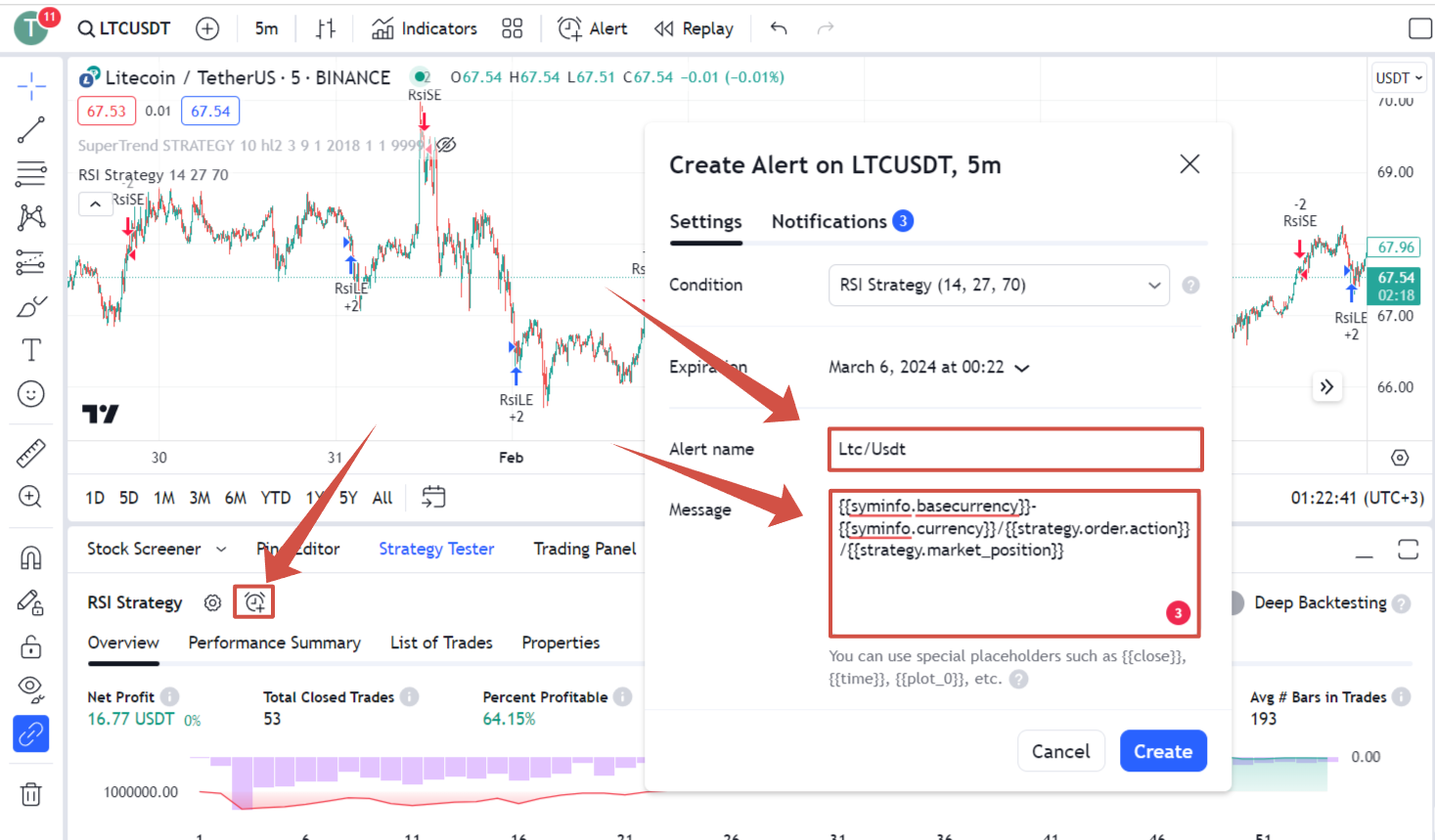

- Next, click on the “Add Alert” button.

In the window that opens, you need to give the alert a name and enter the following command in the “Message” field:

{{syminfo.basecurrency}}-{{syminfo.currency}}/{{strategy.order.action}}/{{strategy.market_position}}

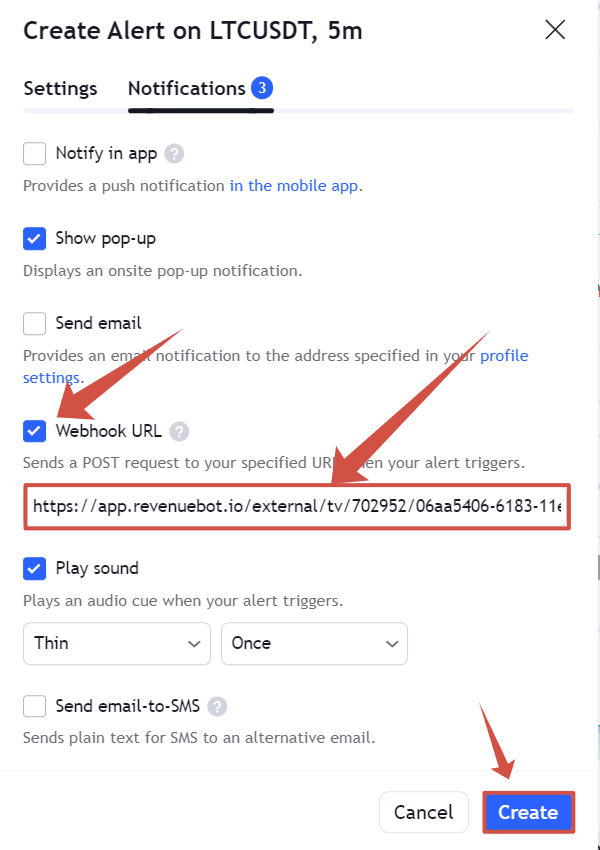

- In the "Notifications" tab, check the box next to the webhook URL and paste the previously received and copied link from RevenueBot into the adjacent field

- Click on the "Create" button.

- Let's go to the RevenueBot platform and launch our bot. When receiving a signal from TradingView, the bot will instantly open a trade.